TaxCore POS

online.taxcore.pos

Total installs

0+

Rating

0.0

Released

May 7, 2020

Last updated

January 26, 2021

Category

Finance

Developer

DATA TECH INTERNATIONAL DOO BEOGRAD

Developer details

Name

DATA TECH INTERNATIONAL DOO BEOGRAD

E-mail

unknown

Website

https://www.frcs.org.fj/fiji-revenue-customs-free-pos-application-issuing-fiscal-receipts/

Country

unknown

Address

unknown

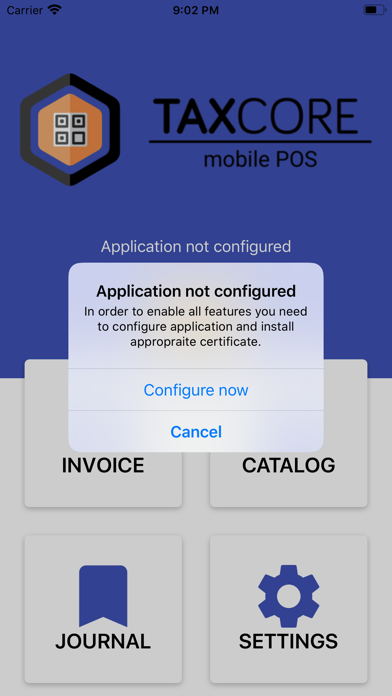

Screenshots

Description

TaxCore free POS is iOS point-of-sale app that gives you minimum compliance (country specific) you need to run your business in accordance with Electronic Fiscal Device Regulations. There are no long-term contracts, no commitments, no support and no surprise fees.

Before using, make sure your jurisdiction has applicable EFD Regulation. For registration user will receive Email from TaxCore provider containing one-time URL for installation of digital certificates and password. If you use accredited E-SDC, make sure you are on the same network (configure IP settings).

FEATURES

TaxCore free POS fulfils minimum requirements for accredited POS you need to start and run your business from your iOS point-of-sale device.

- Record payments

- Send and track invoices from your device

- Customize your products/services with names and prices

- Send fiscal receipts via email, print to PDF or share with b-tooth or different apps

- Issue refunds, copy, training or pro forma (quotations)

-----------------------------

FREE POINT OF SALE FOR IOS

Download TaxCore Point of Sale free

Cashier creates fiscal invoices, manages catalog of products and services, exports and imports data and configures application to work in line with EFD Regulation.

The app supports, Normal, Copy, Training and Pro-forma invoices in both Business-to-Customers and Business-to-Business type of transactions. For B2B transactions Buyer’s Tax Identification number can be inserted during invoice creation.