Varo Bank: Online Banking

com.varomoney.VaroBank

View detailed information for Varo Bank: Online Banking — ratings, download counts, screenshots, pricing and developer details. See integrated SDKs and related technical data.

Total installs

10,000,000+

Rating

4.9(233,481 reviews)

Released

October 1, 2020

Last updated

January 29, 2026

Category

Finance

Developer

Varo Money inc

Developer details

Name

Varo Money inc

E-mail

unknown

Website

https://www.varomoney.com

Country

unknown

Address

unknown

Screenshots

Description

We are a real bank, built for the digital age.

Member FDIC, backed by the full faith and credit of the U.S. Government.

ONLINE BANKING

• Early payday³

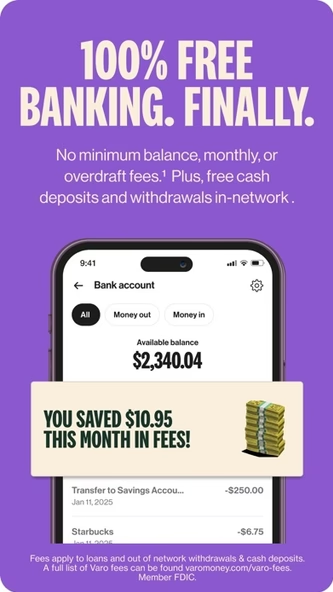

• No monthly, minimum balance, or overdraft fees¹

• 40k+ fee-free Allpoint® ATMs⁴

• Up to 5.00% annual percentage yield on first $5,000, quals apply⁷

• 2.50% APY on additional balances

• Auto-saving tools

• Unlike many money apps, we’re a real bank

INSTANT CASH ADVANCES

• Borrow up to $250 today by linking a qualifying account²

• Work up to $500 cash advances over time with direct deposit²

• Flat fee per cash advance

• 30 days to repay

LINE OF CREDIT

• From $600 to $2,000, quals apply⁵

• No interest, late fees, or penalties

• Simple flat fee

• Payment periods between 3 and 12 months

FREE SECURED CREDIT CARD⁶

• No credit check, interest, annual fees, or min security deposit

• Reported to Equifax, Experian, & TransUnion

• Quals: Must have an active Varo Bank Account in good standing & incoming deposits of $200 or more in the past 31 days

SEND MONEY

• Use recipient’s phone number or email address, even if they aren’t a Varo customer

• Fast, secure, and free!

DOWNLOAD NOW!

• Signup in less than two minutes with no impact on your credit