IDFC FIRST Bank: MobileBanking

com.idfcfirstbank.optimus

View detailed information for IDFC FIRST Bank: MobileBanking — ratings, download counts, screenshots, pricing and developer details. See integrated SDKs and related technical data.

Total installs

33.3M(33,356,105)

Rating

4.8(238 reviews)

Released

December 13, 2020

Last updated

December 4, 2025

Category

Finance

Developer

IDFC FIRST Bank Ltd.

Developer details

Name

IDFC FIRST Bank Ltd.

E-mail

appsupport@idfcfirstbank.com

Website

unknown

Country

unknown

Address

unknown

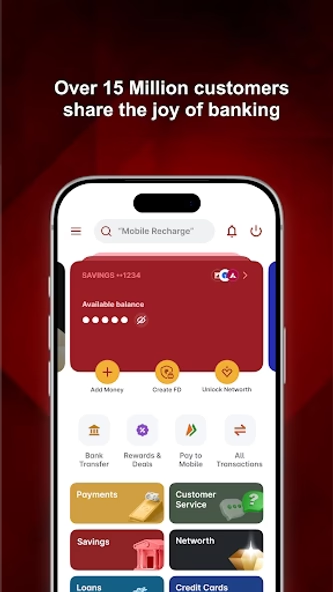

Screenshots

Description

Welcome to IDFC FIRST Bank’s Mobile Banking App. Enjoy a fast and seamless online banking experience, with integrated banking services and exciting features.

Experience the joy of:

* One-Swipe Banking: Swipe to view your account balances and manage credit card/debit card details, deposits, investments, etc

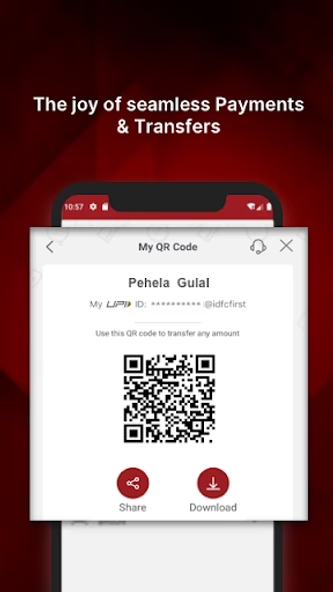

* Instant Payments & Transfers: Make secure payments, UPI transfers, and bill payments

* Zero Fee Banking: Enjoy free Savings Account services, such as money transfers, cheque re-issuance, debit card issuance, and ATM withdrawals

* Tracking Expenses: Monitor cash flow with over 20 automatically categorized transaction types. Link FIRST WOW! & Digital Rupay Credit Card with UPI, earn cashback & rewards on every payment.

* Auto-Sweep Current Accounts: BRAVO Current Accounts with Auto-Sweep to FD for higher interest rates

* Building Wealth: One screen view of your investment portfolio. Get curated investment recommendations based on your risk profile

* Personalized Offers: Get exciting offers across dining, lifestyle, travel & more

* Instant Personal Loans: Avail pre-approved loan offers at attractive interest rates & flexible tenures

*Fixed Deposit: Open an FD in 3 quick steps. Invest online & get guaranteed returns.

Smart App Features and Services

1. Secure Fund Transfers & Payments

⭐ Free fund transfers to any bank account without adding beneficiary

⭐ Easy bill payment and recharge – mobile recharge, DTH & utility bills

⭐ Earn up to 10X rewards on travel/shopping spends via credit cards, redeem anytime for exclusive discounts

⭐ 3-click digital bill payments

⭐ Zero fee money transfer (मनी ट्रांसफर) to bank accounts through IMPS, NEFT, or RTGS

⭐Send money, pay utility & credit card bills, loan EMIs, buy/recharge FASTag, using UPI

⭐ Link bank (बैंक) accounts & view your savings account (बचत खाता) balances with UPI

2. Investment, Mutual Funds & IPOs App:

Explore online investment services:

✓ Invest in Mutual Funds online with Instant SIP

✓ Invest in equity, debt, large-cap and multi-cap

✓ Save tax with ELSS mutual funds

✓ Invest in Unit Linked Insurance Plans (ULIP) and Online Sovereign Gold Bonds

3. Insurance App:

Buy health, bike & car insurance through our app

4. Tripstacc Benefits

☛ Convenient in-app flight & hotel booking experience on the IDFC FIRST Bank mobile app, powered by Tripstacc

☛ ZERO convenience fees on flight booking & earn 20 bonus points for every ₹100 spent on hotel bookings

5. Other Banking Services:

⭐ Apply for debit card & cheque book via app with nil charges.

⭐ View filtered transactions & download Smart Statement + Digest

⭐ Manage credit card payments, download statements, & redeem credit card (क्रेडिट कार्ड) rewards

⭐ Quick purchase & recharge of FASTag

⭐ Zero fee on DD & Pay order issuance & 3rd party withdrawals

⭐ No ECS return fee & decline fee at ATMs for low funds

⭐ Get personalised offers across loans

⭐ One app login for retail, MSME, Customer Service, & Relationship Management

Steps to Download App & Open a Digital Banking Account (बैंक खाता):

☛ Download the banking app & click on open savings account (सेविंग्स अकाउंट)

☛ Register your details & get user ID & password

☛ Log in via user ID & password or mobile number & MPIN

☛ Set up Face ID or finger scanner (biometric) for easy log-in

☛ SIM Binding feature for secure banking (बैंकिंग)

Personal Loan Features:

Loan amount: ₹20,000 to ₹40 lakhs

Personal Loan Tenure: 6 to 60 months

Annual Percentage Rate: 11% to 28%

Representative Example:

Loan amount: ₹1,00,000

Loan Tenure: 12 months

Interest Rate (reducing): 20%

EMI Amount: ₹9,264

Total Interest Payable: ₹11,168

Processing Fee (incl GST): ₹3,499

Disbursed Loan Amount: ₹96,501

Total Amount Payable: ₹1,11,168

Total cost of Loan (Interest + Processing Fee): ₹14,667

Disclosure:

By downloading the IDFC FIRST Bank Mobile App, you agree to our Terms & Conditions, as well as IDFC FIRST Bank’s privacy policy. To go through the T&Cs, please visit https://www.idfcfirstbank.com/terms-and-conditions